Notice of Assessment: What is CRA Notice of Assessment and How to Get it?: We suggest that all eligible taxpayers in Canada must read this article and know in detail about CRA Notice of Assessment: What it is and How to Get it. And a Complete Guide.

CRA Notice of Assessment

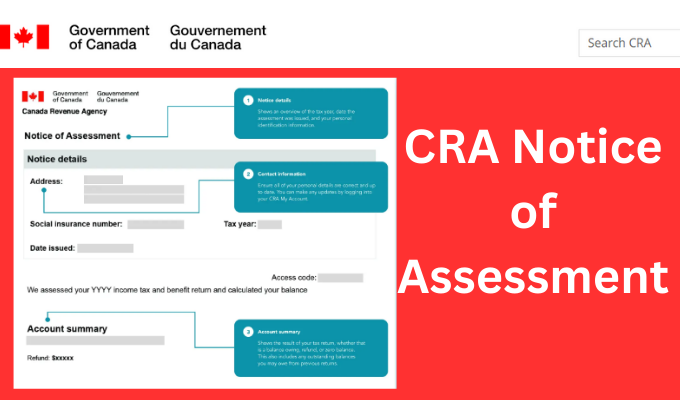

After completing tax returns, the Canada Revenue Agency (CRA) sends a Notice of Assessment to every Canadian taxpayer. It is CRA’s way of saying that their tax returns have been received. The CRA NOA lists the taxes that must be paid or refunded and summarizes the taxpayer’s tax assessment results.

You can determine whether you owe the Canada Revenue Agency money or if you are done for the year once you receive your notice of assessment. Apart from this, the CRA NOA verifies that the taxpayer’s estimate of the taxes they owe matches the CRA’s estimate.

|

Important Links |

If you are an eligible taxpayer in Canada, then you must read this article. Here, we have discussed in detail about CRA Notice of Assessment, its importance, and the necessary processes involved.

What is a Notice of Assessment?

An estimate of the income taxes due by the income tax filer for a particular tax year is provided by the government and is called a notice of assessment. It functions as a receipt from the Canada Revenue Agency verifying that your income tax return was successfully filed.

Based on the data that taxpayers provide on their tax forms, NOA’s figures and assessment results are determined. A Notice of Adjustment (NOA) is an essential document that provides you with the status of your tax return.

It notifies you of any revisions or potential issues with your tax return so you can take corrective action. Furthermore, a NOA determines if a company or individual is auditable or if their return was acceptable. Tax filers have ninety days from the date on the NOA to submit formal online objections online or via mail.

CRA Notice of Assessment Overview

| Article Name | CRA Notice of Assessment |

| Issuing Authority | Canada Revenue Agency |

| Purpose | To provide the tax assessment details of the taxpayers. |

| NOA Issuing Time-period | 14-28 days |

| Receiving Mode | Mail or CRA portal |

| CRA Online Portal | https://www.canada.ca/en/revenue-agency.html |

CRA Notice Of Assessment Details

The NOA issued by CRA contains 4 main sections. The first section provides information on your account, like the amount you owe, any tax refund you are eligible and any other relevant details. The next section, which is the main section of your NOA, provides the complete summary of your tax assessment.

The third section in your CRA Notice of Assessment will inform you about necessary changes and updates that you are required to make. This section will also explain the need to update the details and also has all the other important information. The fourth and last section of the NOA has information about your RRSP (Registered Retirement Savings Plan) contribution and deduction for the next taxable year.

How to Get Notice of Assessment CRA?

Upon receiving your return, the CRA instantly notifies you of your evaluation. A taxpayer can anticipate receiving the NOA 14-28 days following the submission of their tax returns. After you file your tax return online, the CRA usually sends you a notice of assessment 14 days later.

|

Important Links |

You will receive the notice of assessment about 28 days after the return is received if you filed it via mail. You can also obtain a copy of your NOA, either through CRA My Account or registered mail, as soon as it is issued.

You can obtain a copy of your NOA online through CRA My Account as soon as it is issued. Under the “My Account” function of the CRA, the option is activated. Taxpayers can use the “My Account” option to view the progress of their returns as well as the NOA and download their NOA statement.

Process After Receiving NOA

You should receive your notice of evaluation within a month, as previously specified. You have to pay the desired sum (if any) as soon as you get the notice. If the CRA receives too many tax payments from you, you can be eligible for a refund. You are required to complete all necessary actions in accordance with your CRA NOA.

Another option is to disagree with the CRA’s NOA. Any objection must be based on a disagreement with the CRA’s assessment of taxes due or on how the CRA has interpreted the income tax law. Notes of assessment from the federal and provincial governments attest to the fact that you have submitted your income tax returns to the relevant tax authorities, so it is crucial that you preserve them.

We are hopeful that you might have found this article on CRA Notice of Assessment interesting and worth reading. You must explore our website to find articles and informative details on various government schemes and policies.

| CRA Official Website | Click Here |

| Get NOA Copy | Click Here |

| ITG Home | Click Here |

The government is doing everything wrong

A CRA (Canada Revenue Agency) Notice of Assignment is a document that informs you that a creditor has assigned a debt you owe to a third party, such as a collection agency. This notice is sent to you to let you know that you should now deal directly with the assigned party to address the debt.

To get a CRA Notice of Assignment, you typically receive it through the mail or electronically from the Canada Revenue Agency or the creditor who assigned the debt. If you receive such a notice, it’s essential to follow up with the assigned party to discuss your debt repayment options and any questions or concerns you may have regarding the debt.

If you are unsure about the details of a Notice of Assignment you’ve received or have specific questions about your situation, it’s a good idea to contact the CRA or the creditor for clarification and guidance.